iPartners is redefining wealth creation.

Since 2017, we’ve been opening the door to alternative investments that were once reserved for institutions and family offices. From funds management to capital markets, we give investors access to distinctive opportunities backed by specialist expertise and disciplined structuring. Our focus is simple: helping investors find more ways to wealth.

Smart investing. Made simple.

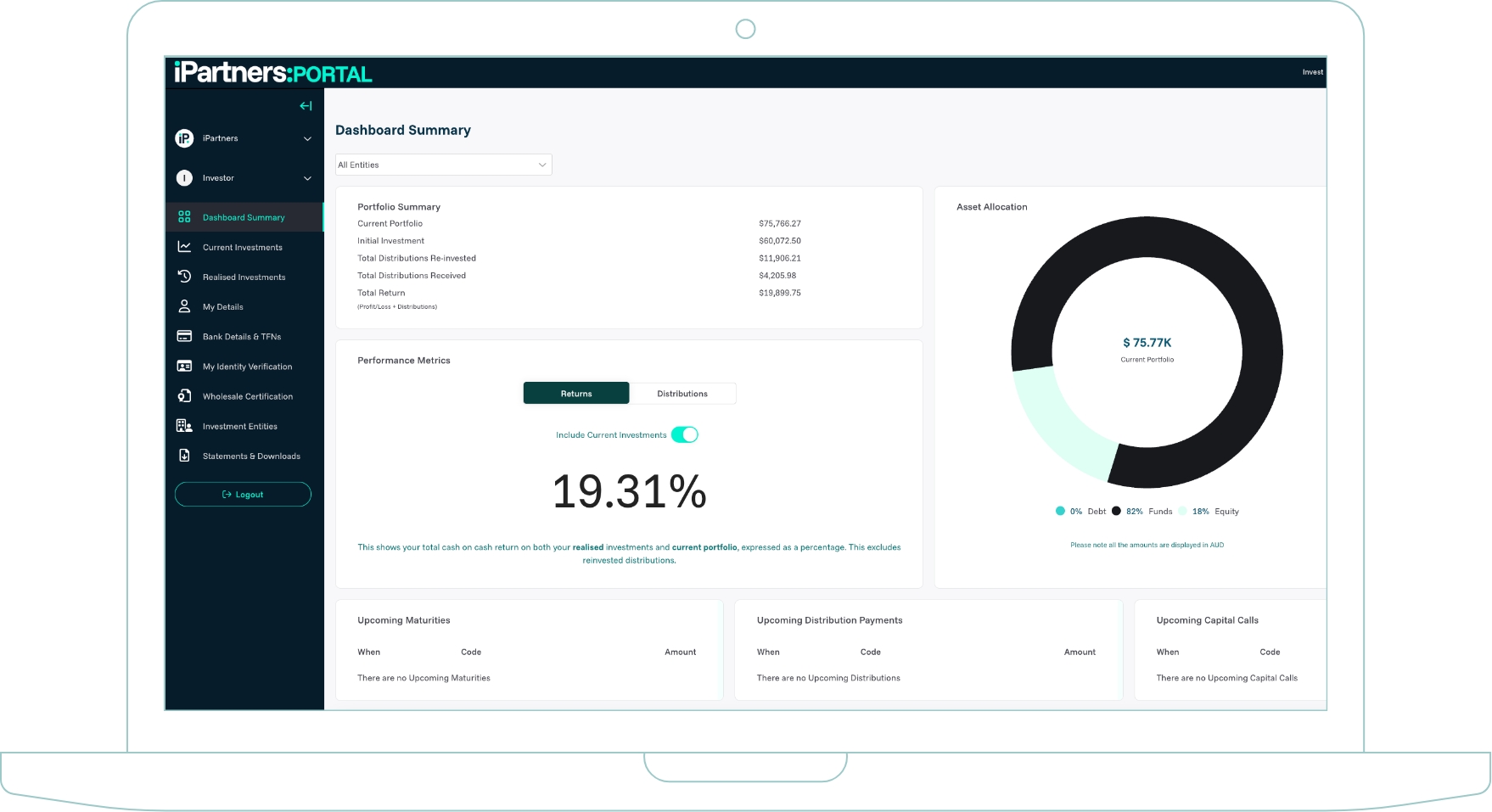

Our platform

Our innovative digital platform puts investors in control – making it easy to discover, assess, and invest in unique opportunities anytime, anywhere. With seamless technology, transparent processes, and a team with deep sector knowledge, we empower investors to build their wealth their way.

Why iPartners

Our platform ensures an intuitive, digital investment process with a minimum investment size of $10,000.

What our clients have to say

Knowledge Hub

Home to our blogs, webinars and podcasts.